Dublin - Changes impacting the synthetic rubber (SR) industry and its markets in different world regions were the main theme at the annual meeting of the International Institute of Synthetic Rubber Producers (IISRP).

At the event held 7-10 April in Dublin, Eugene Zubov of market intelligence agency Chem-Courier provided an in-depth analysis of the current state-of-play for the SR industry in the EU, USA, Asia and Russia.

In his analysis, Zubov covered production and trade-flows for styrene-butadiene, polybutadiene, nitrile, butyl, halobutyl, polyisoprene and EPDM rubber, from 2019 to 2025.

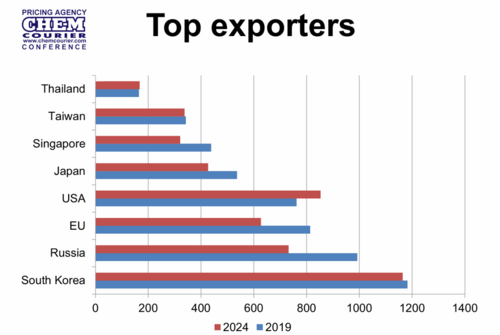

In 2024, the top exporters of synthetic rubber were South Korea followed by the US, Russia, the EU, Japan, Taiwan, Singapore and Thailand, according to the presentation.

While total volumes changed only slightly – decreasing from 6 million tonnes to 5.8 million tonnes – the five-year reviow period saw significant reductions in exports from both the EU and Russia.

Globally, SR imports also declined, from 7.0 million tonnes to 6.3 million tonnes between 2019 and 2024, though with China significantly reinforcing its position as the largest buyer.

In sharp contrast to the growth in China, imports to second-placed EU registered a substantial decline, while the US was edged out of third place by India and Thailand, continued Zubov.

Key developments for EU producers, he said, included the ban on SR imports from Russia since July 2024 and the negative impact of high energy costs on production and market demand in the region.

These developments were reflected in the report data, which showed that SR exports from the European bloc had fallen by 23% since 2019, while imports registered a 22% decline.

In the six months before the ban, imports of SR from Russia to the EU grew substantially, including year-on-year increases of: 226% for IR and 49% for butadiene rubber (BR).

Looking ahead, the EU export situation was likely to remain challenging, not least due to “possible 25% tariffs on imports to the US and fierce competition with Russian suppliers in China and Turkiye.”

Furthermore, the ChemCourier presenter pointed to the challenges posed by “expected reductions in feedstock availability [and] higher production costs compared with competitors.”

Indeed, feedstock supply is becoming a significant issue for European producers, due to the closedown of crackers – Zubov citing rationalisation and restructuring moves at ExxonMobil, Versalis and Sabic.

As the ChemCourier analyst summarised: “Expensive energy, competition with Russian SR in China and Turkiye and US tariffs are jeopardising EU exports, while several cracker closedowns will reduce C4 supply in Europe.”

SR producers in the US have fared much better than their European rivals, Zubov estimating that the country achieved strong growth in exports over the last five years: up 12% since 2019.

The US was listed as the world’s largest exporter of EPDM rubber and ranked among the top three exporters of BR and a major importer of SBR from the EU and South Korea.

In the domestic market, however, Washington’s threatened imposition of tariffs on butadiene from Canada and SBR from Europe looks set to make rubber in more expensive for customers in the US, Zubov cautioned.

In the feedstock arena, the US has enhanced its own production position, though is still very reliant on butadiene imports, especially from Canada.

China has clearly become a powerhouse for the global SR industry, with imports up by 185kt since 2019, and exports rising by 645kt, a more than four-fold increase. The country is also substantially increasing its butadiene feedstock production.

At least seven new SR facilities with the total annual capacity of 525kt will come on stream in 2025, said Zubov, noting that this will add to the 865kt from 11 units announced for startup in 2022-24.

The surge in new capacity is being supported by increasing demand from south Asian and southeast Asian countries, including Cambodia which is becoming a major producer and exporter of tires.

Another feature is the emergence of Russia as China’s largest trade partner by adding 412kt to SR imports since 2019, while imports from the EU by 50kt.

In Russia, output dropped by 6.6% and exports by 26%, the latter decline including a 76% drop in sales to the EU dropped, Zubov noting that the country remains “self-sufficient in butadiene and styrene feedstock and has overcapacity in SR, which it needs to export.”

According to the analyst, Russia’s loss of business to the European market was more than offset by increased exports to China and Turkiye – up 180% and 49% respectively – as well as 53% higher domestic demand.

But sanctions, linked to Russia’s invasion of Ukraine, mean that there are few foreign markets for its materials, Zubov adding that “imposed sanctions and growing output in China are causing concerns over [future prospects for] Russia’s SR exports.

Over the review period, Russian producers were further hampered by difficulties in importing catalysts and equipment, as well as sanctions-related restrictions on bank-payments and difficulties in importing equipment for plant repairs.

However, some of these challenges are now being addressed with, for instance, main producer Sibur planning to start its own production of n-butyl lithium catalysts by 2026, according to the presenter.

Read the full ERJ report from the IISRP annual meeting in Dublin.