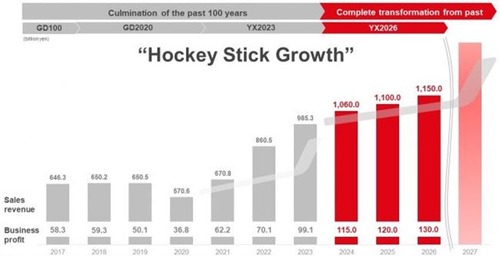

Hiratsuka, Japan – Yokohama Rubber Co. (YRC) has unveiled its latest mid-term management plan for the three years to end of 2026 (YX2026), which it says will bring about “hockey stick growth” over the three-year period.

Through the plan, the group aims to deliver a business profit of Yen130 billion (€804 million) and profit margin of 11% by 2026, up 31% from Yen99 billion and a 10% margin reported in 2023.

Sales revenue is expected to reach Yen1,150 billion, up 17% from Yen985 billion reported last year, YRC announced 16 Dec.

The growth, the group explained, will be achieved through allocating about Yen320 billion for strategic investments and investments in ongoing operations.

The growth, the group explained, will be achieved through allocating about Yen320 billion for strategic investments and investments in ongoing operations.

As part of the new strategy, YRC will, among other areas, focus on “low-cost and speedy development of quality products”.

Defining “quality products”, YRC said it aims to strengthen the development of OE tires suitable for "the next generation of premium cars".

The “low-cost” focus will see the group centring its efforts on “drastically reduced costs that can’t be beat by other companies”.

One-year plant challenge

Furthermore, the Japanese tire & rubber group will implement a “one-year plant” challenge for its "speedy" strategy.

Labelled as the “centrepiece of consumer tire strategy”, the challenge aims to bring new plants on line within one year and achieve “the low cost and high efficiency needed to compete with the cost-competitiveness of emerging tire makers”.

This, YRC added, will help the group achieve its “hockey stick growth” targets and its speed up tire development.

The move, said the group, is in response to low-cost, low-price emerging tire makers which have been expanding their production capacity and their market share over the recent years.

Furthermore, during YX2026 YRC said it would “accelerate its efforts to maximise the sales ratio of its high-value-added tires".

This will enable the group to increase the profitability of its consumer tire business.

To that end, the group said it would aim to 'enhance brand value, promote tires as OE for premium cars, and continue its participation in motorsports events around the world.'

Off-highway amibitions

For off-highway tires (OHT), YRC said the global market size is Yen4 trillion and is expected to grow 6% a year, compared to the projected 2% annual growth for the consumer tires.

Agriculture and forestry machinery is estimated to account for about 40% of the global OHT market, with YRC claiming the “top share in this market segment”.

Here, YRC said it plans to strengthen its market position by implementing “a multi-brand strategy” that will leverage its production, sales, and technology strengths in "all three tiers of this market segment".

Also, the new mid-term plan aims to expand the global operation of YRC’s Interfit tire maintenance service, which will help realise the group’s ambitious growth target.

For the construction and mining machinery segment, YRC said it would consider “programmatic M&A” as a measure to boost its “as yet rather small shares” in the global market.

Touching on the truck and bus tires segment, YRC said “emerging tire makers” are also expanding production capacity and increasing their supply globally.

However, it noted that the low-cost tires are facing antidumping and countervailing measures by Europe and the US.

As a result, YRC said it aimed to “strengthen sales in countries and regions where such measures are supporting the maintenance of appropriate pricing.”

Industrial rubber growth

For its multiple business (MB), focused on the supply of industrial rubber products, YRC said its previous YX2023 business plan led to the creation of a new business platform that will generate strong revenues.

Positioned as a growth driver in YX2026, the hose & couplings business "will restructure its value chain and North American production network."

The industrial products business will “solidify its leading share” in Japan’s conveyor belt, while “internal reforms” will be carried out to to establish "a more stable high-profit structure" in the marine hose operations.

The MB business as a whole aims to achieve a 10% business profit margin in fiscal 2026 and elevate its presence within the YRC group.

Sustainability goals

In terms of sustainability, the group said it would give “serious consideration to environment-related investments” over the three-year period.

The new plan, for example, aims to reduce the group’s 2019-level Scope 1 & 2 emissions of greenhouse gases by 30% by 2026 and 40% by 2030 while also reducing costs.

Also, to reduce Scope 3 emissions, YRC will promote greater use of sustainable materials and has targeted increasing its sustainable materials ratio to 28% in 2026 and 30% in 2030.

Recap of YX2023

On the achievements of YX2023, YRC said its tire business achieved a major transformation of structure.

The group strengthened its “highly-profitable” OHT business to bring its consumer tire–commercial tire sales composition in line with the global tire market ratio of 1:1.

The ratio was previously 3:2, weighted toward consumer tires, according to YRC.

In addition, Yokohama Rubber steadily implemented measures to enhance asset efficiency, including the sale of certain businesses and subsidiaries.

“As a result, during the three years of YX2023, Yokohama Rubber achieved record high sales revenue and business profit every year,” it added.