Report: Tire cord market on growth track to 2024

Ocean View, Delaware – The global tire cord & tire fabrics market was worth $3.85 billion in 2015, is growing by more than 5% a year, and could reach $6.4 billion by 2024, forecasts Global Market Insights Inc (GMI).

In a new study, GMI said the global market is mainly driven by automotive-industry growth, particularly in China and India, but also elsewhere in Asia as well as in North America. On the back of these trends, the study noted “a splurge in capacity addition” for nylon and polyester tire cords in the Asia Pacific.

Asia Pacific, led by India, Japan, China, Indonesia, dominated the global tire cord and tire fabrics market share in 2015, said GMI. Here demand is being driven by increasing consumer income in China and India and moves by automotive majors to set up new manufacturing and sales facilities in the region.

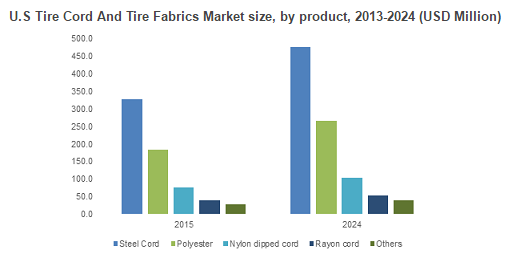

The report valued the North American tire cord and tire fabrics market at around $800 million in 2015. The market, it said is now benefiting from a growing US economy and a large customer base for high end luxury cars and SUVs.

The market outlook in Europe is less promising, with automotive sales decreasing due to stagnant GDP growth, said the report. However, it added that the development of bio-based and environment friendly substitutes to traditional tire cord materials will open up new growth avenues for the industry participants.

Looking at product trends, the report put the steel tire cord and tire fabrics market share at over $1 billion in 2015. Growth in this segment, it said, is largely propelled by the growing radial tire demand in North America, where it is extensively used in commercial vehicle tires.

Polyester, which is extensively used in passenger car tires, is forecast to grow at over 5% CAGR over the study period to 2024 – helped by its ability to deliver required physical properties at low cost.

Market share

The report lists the major players in the global tire cord and tire fabrics market share as including Hyosung Corp., Bekaert, Kordsa Global Inc., SRF Ltd and Kolon Industries, Inc. Other prominent participants, it said, are Teijin Ltd, Kordarna plu6s AS, Firestone Fibers & textile Co., Cordenka GmbH, Tokusen USA and Milliken & Co. Inc.

Companies such as Bekaert are involved solely with steel cord manufacturing, whereas companies such as Hyosung and Kordsa are involved in manufacturing more than one type of tire cord material, noted GMI.

Overall market leader Hyosung, for instance, is the industry leader in the polyester tire cord with considerable share in the steel tire cord segment as well. It is involved in the production of polyethylene naphthalate tire cords and aramid, in smaller capacities.

This article is only available to subscribers - subscribe today

Subscribe for unlimited access. A subscription to European Rubber Journal includes:

- Every issue of European Rubber Journal (6 issues) including Special Reports & Maps.

- Unlimited access to ERJ articles online

- Daily email newsletter – the latest news direct to your inbox

- Access to the ERJ online archive