Article published in ERJ's January-February issue

R&D spending in the tire industry remains stable in contrast with the dynamic changes in technology that lie ahead

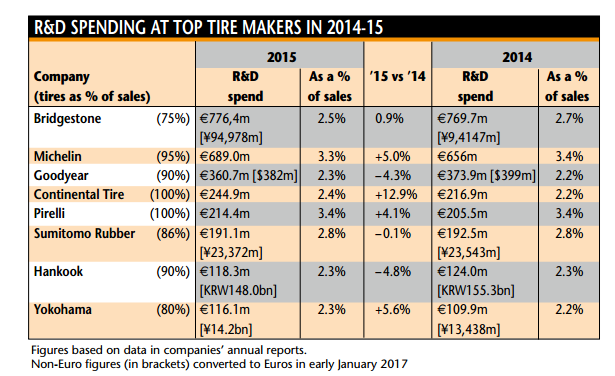

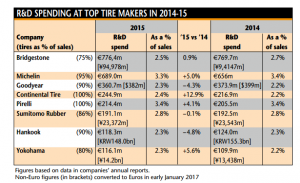

There were some significant changes in R&D spending between 2015 and 2014, most notably at Continental, where spending rose by 12.9% to €245 million. On the other hand, Goodyear’s R&D expenditures were $382 million, in 2015, lower than the levels of $399 million and $390 million recorded for 2014 and 2013, respectively.

But as a percentage of sales, there was little change in R&D spending levels at either of these companies – a trend repeated for every company in this survey.

Typical is second highest spender Michelin, whose R&D expenses rose by 5% from 2014 mainly due to currency effects. As a percentage of net sales, R&D expenses were stable at 3.3%, versus 3.4% in 2014.

It should be noted that spending on non-tire rubber activities could mask fluctuations at some of these players.

At Sumitomo Rubber Industries (SRI), for instance, R&D expenses fell 0.7% to ¥23,372 million, while the ratio of such expenses to net sales remained unchanged at 2.8%.

SRI’s tire business accounted for ¥19,865 million of these expenses, down 3.3% from the previous fiscal year, the sports business ¥1,602 million, up 8.4%, and its ‘industrial’ and ‘other products’ business ¥1,904 million, up 25.1%.

Overall, though, warchests like that approaching Ä700 million at Michelin, and Ä800 million in the case of top spender Bridgestone, could make some significant in-roads in areas such as digital manufacturing and in improving the environmental profile and performance of tire products throughout their entire life-cycle.

But what is all this money being spent on?

A particular focus of investment at present is on beefing up global R&D centres, as evidenced by Michelin’s upgrade at Ladoux, France (see p17), and Hankook’s Technodome (see p20). Last year also saw Continental open its high performance technology centre in Korbach, Germany which will produce both tires for high performance vehicles and develop new manufacturing technologies for Conti plant worldwide (p19).

There is a steady build-up of virtualisation and simulation capabilities as evidenced, for example, at Michelin’s Ladoux centre. SRI is working on a technology capable of large-scale simulations covering all stages of R&D, from raw material development to tire performance, with fiscal 2020 set as the target year.

Investment in skills is arguably an even higher priority, with major training and recruitment drives, for example, last year at Bridgestone’s European Technical Centre in Rome and most recently by Hankook for its newly opened Technodome in Daejeon, South Korea.

There also seems to be a shift in the type of skills employed by the tire industry in line with the emerging challenges and opportunities presented by the digital era.

Continental, for instance, recently appointed Kurt Lehmann as its first ever corporate technology officer (CTO). His remit includes tracking trends in automation, connectivity, and new mobility and exploring possibilities offered by artificial intelligence, wireless and robotics – perhaps a sign of things to come at all major tire and rubber manufacturers.