Based on a story appeared in the 3 July print edition of Tire Business, a US sister publication of European Rubber Journal

Mexico City — Buoyed by a mushrooming automotive industry, record domestic vehicle sales and compliant unions, the tire industry has rarely had it so good in Mexico.

But the Trump factor and the influx of used tires into the country's price-driven market over the past decade continue to cause disquiet.

President Trump's public slamming of the North American Free Trade Agreement (NAFTA) among the U.S., Canada and Mexico has prompted his administration to launch a review of the accord, implemented in January 1994.

Mexico's business community is hoping for a positive outcome, although uncertainty persists. For instance, Humberto Gómez, managing director of Yokohama Rubber Co. Ltd. (YRC) subsidiary Yokohama Tire México S. de R.L. de C.V. told Tire Business in June 2016 that YRC, wanted to increase its production capacity in the NAFTA region.

A new factory would be built in either the U.S. or Mexico and he expected a decision on where by the end of 2016. A year later, Yokohama has still not made an announcement. Trump-related wariness? Maybe. Yokohama has not said.

Onward for Goodyear

In January, Ford Motor Co., which Trump regularly criticised during the presidential campaign for creating jobs outside the U.S., canceled the $1.6 billion light vehicle assembly plant it was constructing in San Luis Potosí in central Mexico. It had planned to make 350,000 small cars a year at the facility and insisted it would not bow to political pressure. Whether or not Trump influenced its decision is open to speculation.

"There is concern, especially in the automotive industry, and we have to watch the situation very carefully," Franco Herrera Sánchez, Guanajuato state's under-secretary of investment promotion, told Tire Business, referring to Trump's election victory. Guanajuato has a large automotive industry cluster of several hundred companies.

However, Akron-based Goodyear, which broke ground on its first plant in the Americas for a quarter of a century (also in San Luis Potosí) in July 2015, has pressed on with plans.

Known internally as the "Americas Project," the $550 million facility is slated to be operational starting in July. In 2015 Goodyear said the plant would have an annual production capacity of 6 million high-value-added tires, such as the Eagle F1 and Wrangler All-Terrain Adventure with Kevlar.

Goodyear operated a plant in Mexico, in Tultitlán, a dozen or so miles outside Mexico City, for 60 years but shut it down in 2001 "because its high costs are incompatible with current economic conditions," the company said at the time.

Used tires a danger

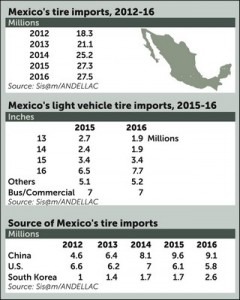

Mexico's 2,400 or so tire dealers sold 39.4 million new tires in 2016, according to Elizabeth Ventura Rendón, president of their national association, Asociación Nacional de Distribuidores de Llantas y Plantas Renovadoras AC (ANDELLAC).

However, the legal and, in some cases, illegal importation of up to 2 million used and low quality tires annually from China, South Korea and the U.S. has blurred the domestic replacement tire picture.

"There's no protection (for the national industry)," Ventura said in a 2016 Tire Business interview, adding that the association was lobbying the federal government to try to get the imports stopped. However, it was still an issue in June this year, an ANDELLAC spokesman told Tire Business. "Used tires are dangerous," he said.

"The authorised annual quota of imported used tires that are sold along Mexico's frontiers has been 840,000 units in recent years," a spokesman for national rubber industry chamber CNIH said.

"However, in recent years between 1.1 million and 1.2 million have been imported." Others say the imports are on a considerably larger scale.

According to Ventura, cheap imports comprise 60% of the national market for commercial vehicle tires — from 20-inch diameter rims and upward.

Following the lead of her predecessor, Raúl Castillo Arteaga, she wants to turn Mexico into a market based on technology, rather than on price.

In the official ANDELLAC magazine, Castillo once wrote: "I disagree with those who affirm that…customers make decisions based on price. They do that when we, whose job it is to act as consultants, fail to offer them any other means of comparison."

Tires are not commodities, he added, but manufactured goods that require a high degree of engineering sophistication.

Statistics, new plants

Bridgestone Americas, Michelin North America, Continental Tire the Americas, Goodyear and Pirelli & C. S.p.A. are among the leaders in a market that boasts about 100 different brands. Some reports say the quintet satisfies 40% of the demand for new passenger car and light truck tires in Mexico.

The country's state-run statistics office, Instituto Nacional de Estadística y Geografía (INEGI), said the country produced 21.6 million tires for passenger cars and pickups in 2015, up from 20 million in 2014. That figure increased by several million in 2016, according to Ventura.

The country has nine tire factories. Bridgestone has two, Continental, Cooper, Pirelli and Michelin have one each, and JK Tornel has three. Castillo described them as "first-world, more modern than in most other countries."

Pirelli is building a second tire factory at its 1.5-million-sq.-ft. manufacturing complex in Silao, 220 miles northwest of Mexico City. It expects to start production there this summer.

The company plans to reach the complex's production capacity of 7.5 million premium tires for cars and light trucks a year by year-end 2018. Current production is 5 million tires annually.

A second Michelin plant in Mexico is under construction in nearby León at a cost of $510 million. Covering 1.5 million square feet, it is scheduled for completion in late 2018 and will have an annual installed production capacity of 4 million or 5 million Michelin-brand tires a year. Most of them will be for 18-inch-plus rims in the North American OEM and replacement markets.

Most of the plant's output will be exported to the U.S. and Canada, Scott Clark, executive vice president and COO, Michelin North America, told Tire Business last August.

The new Goodyear, Pirelli and Michelin facilities are not included in the above list of nine tire manufacturing plants.

Light vehicle output

Imports of rubber products were valued at $6.1 billion in 2015, of which 52.3% were new tires and 8.2% new inner tubes, INEGI said.

Of the total imports of rubber products in 2014, it said, 48.5% were from the U.S. and 16.7% from China. Other countries from which Mexico imported rubber products were Japan (4.5% of the total), Canada (4.4%), South Korea (3.9%), Germany (3.2%), Brazil (2.2%), Thailand (1.7%), France (1.6%), Indonesia (1.5%) and others (11.8%).

China's share of rubber product imports grew from 1.7% in 2002 to 16.7% in 2014.

Sales of light vehicles in Mexico through May totalled 615,641 units, 4.8% more than in the same period a year earlier, according to Mexico's automotive industry association, the Asociación Mexicana de la Industria Automotriz AC (AMIA). Of the total, 42% were vehicles assembled in Mexico, while 58% were imported.

In the first five months of the year, Mexico assembled 1.55 million light vehicles, 14.4% more than in January-May 2016.

In a government trade and investment agency report on the Mexican automotive industry, published in late 2016, Eduardo Solís, AMIA's executive president, wrote that light vehicle sales in Mexico were growing.

"Production and exports have reached levels without precedent in our sector's history.

"We firmly believe in AMIA that … we can consolidate our country as one of the leading research, development and innovation centres in automotive technology. This is the main challenge for our sector," he wrote.

Brazil

The situation is Brazil is less rosy. According to market researcher IHS Markit Ltd., light vehicles sales in the country plummeted by 19.8% in 2016, and light vehicle assembly dropped 11.7% from 2015. Exports increased by 25.7%.

The national motor vehicle manufacturers association, Associação Nacional dos Fabricantes de Veículos Automotores (ANFAVEA), said the industry was operating at only 48% of its capacity by the end of 2016.

IHS Markit quoted Brazilian sources as saying passenger car sales dropped to 1.67 million units and sales of light commercial vehicles to 311,876. It blamed the situation on "low consumer confidence, increasing unemployment and weak credit availability."

According to the Associação Nacional da Indústria de Pneumáticos (ANIP), 20 companies have manufacturing plants in Brazil, including Michelin, Pirelli, Goodyear and Bridgestone.

The ANIP said 68.87 million tires were produced in 2016 in the country, with more than half of those (54%) bus tires.

ANIP statistics show that while tire imports have decreased over the last five years, the number of Chinese tires imported into Brazil has increased. In 2012, Chinese imports accounted for a little more than 20% of all imported tires into Brazil, while that number has surpassed 30% for the first five months of 2015.

Argentina

In neighboring Argentina, the light vehicle market grew 10.8% in 2016, IHS Markit said, predicting similar growth (10.4%) in 2017 "as auto makers push sales in Argentina to offset Brazil declines."

It expects the market to approach 730,000 light vehicles per year in 2022 and possibly to reach 800,000 per year in 2025.